Canada Business Trends Seminar 2025

Business Expansion and Immigration to Canada (50 Attendees)

Co-hosted in Nagoya by Tokai Japan Canada Society and Manning Elliott

The Tokai Japan Canada Society (TJCS), and Canadian CPA firm Manning Elliott co-hosted a seminar entitled "Canada Business Trends Seminar - Doing Business in Canada 2025". About 50 participants, including Japanese companies considering entry into Canada, gathered in Nagoya to obtain the latest business information and concrete guidance on visas, while also expanding their networks.

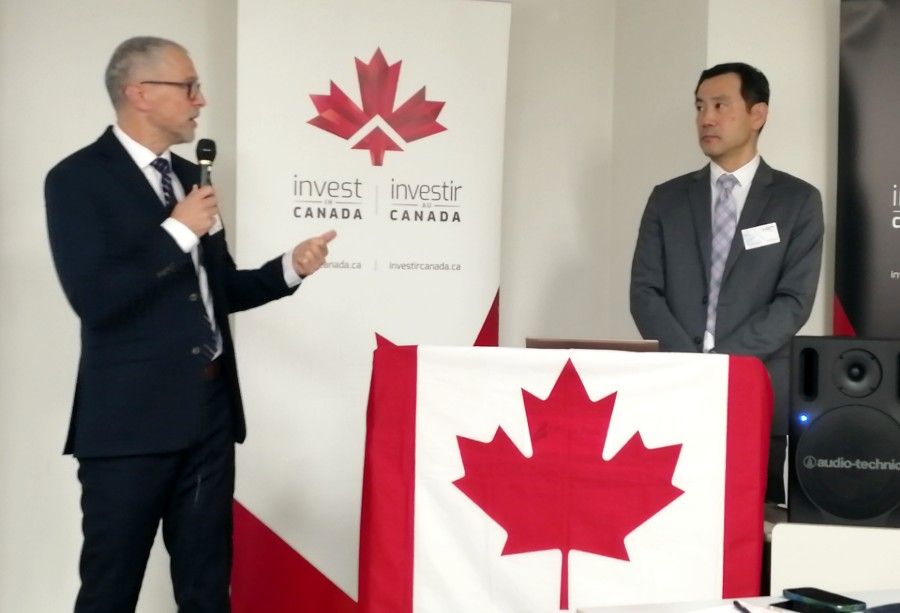

The seminar kicked off with opening words from TJCS President Shoji Amano and David Perdue, Consul at the Consulate of Canada in Nagoya. In his remarks, Consul Perdue emphasized that Canada "remains an attractive destination for investment thanks to its stable economic base, abundant natural resources, and a society that values diversity.” He added that “under the latest federal budget, proactive tax incentives have been introduced to attract international investment further and enhance the overall business environment."

The Seminar

In Part I of the seminar, Osamu Takizawa, President of OGT Canada Enterprise Ltd. (British Columbia), delivered a talk entitled "It Was a Bet on My Life: Moving to Canada as a Sole Proprietor with a 365-Day Deadline". He described moving to Kelowna in March 1999 to pursue overseas migration and entrepreneurship, launching an export business of Canadian wines to Japan in 2000, winding down that wine sales operation this spring, and beginning sales of wines from the Republic of Azerbaijan this fall.

Drawing on these experiences, he spoke about mitigating business risks by withdrawing from or redesigning parts of his service lineup. He also shared that he travels from Canada to Japan twice a year to host wine events and workshops on graceful comportment/etiquette across the country, which has helped broaden his network.

Next up, Yuji Matson, a lawyer at Remedios & Company (British Columbia), provided an overview of Canada's immigration system. In addition to explaining the Labour Market Impact Assessment (LMIA) that Canadian employers submit when hiring foreign workers, he covered work permits and other visa categories.

Finally, Manning Elliott, partners David Diebolt, CPA and Hirotatsu Ochiai, CPA, delivered an update on Canada's investment climate for Japanese companies. Looking ahead to 2026, they expect modest positive growth in GDP but stressed the need to monitor developments closely, noting that the outlook will be significantly influenced by trade frictions with the United States. They also explained corporate income taxation in Canada, including which entities may be exempt and the related filing and payment obligations.

Q&A Session

The seminar concluded with a Q&A session featuring all of the evening's presenters.